See the information on this webpage in:

- Amharic / አማርኛ

- Chinese / 中文

- French / Français

- Korean / 한국어

- Spanish / Español

- Vietnamese / Tiếng Việt

If you need language interpretation, call 410-767-2165 (toll-free 1-866-650-8783) and ask for language assistance.

Income Tax Offset Credit (ITOC)

Don’t lose your $692 tax credit!

Montgomery County’s Income Tax Offset Credit (ITOC) program grants County residents who live in the property they own a $692 credit.

The State law changed. To receive the ITOC, residential property owners must now have a Homestead Tax Credit (HTC) on file with the Maryland State Department of Assessments and Taxation (SDAT) by May 1st . If a property owner does not file this one-time application before this deadline, they will not receive the $692 tax credit on future bills until the State processes their application. Once the application is on file, it will automatically apply to future years.

Deadline: May 1st

-

Step 1: Check if you have already filed a Homestead Application.

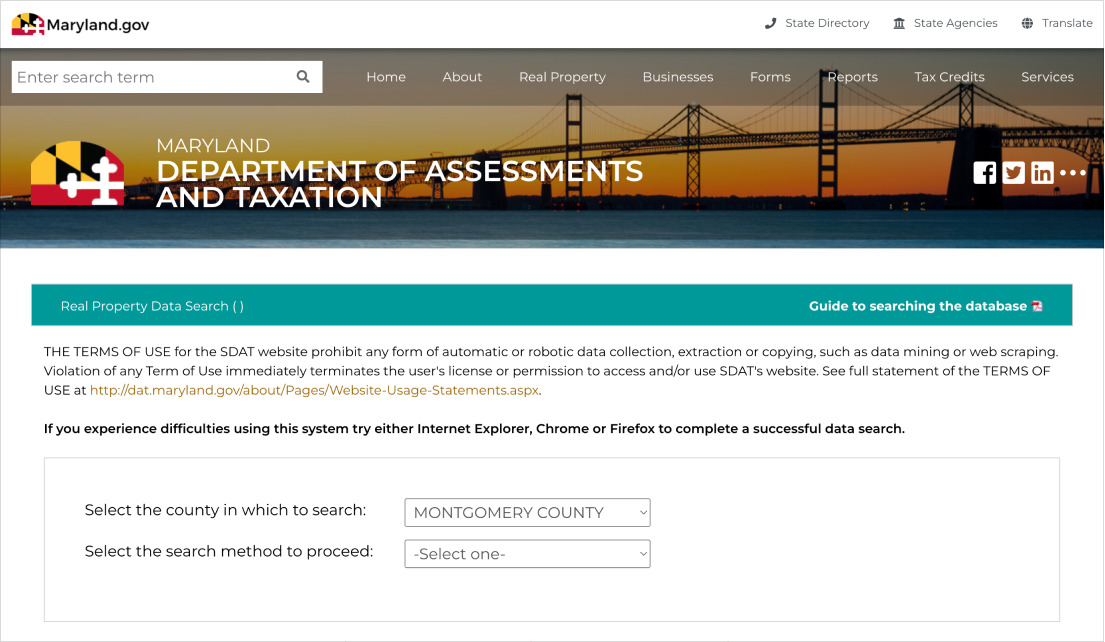

- Go to

https://sdat.dat.maryland.gov/RealProperty/.

- Select “Montgomery County” in the first drop down menu (as shown)

- Choose your preferred method in the second drop down menu to find your property.

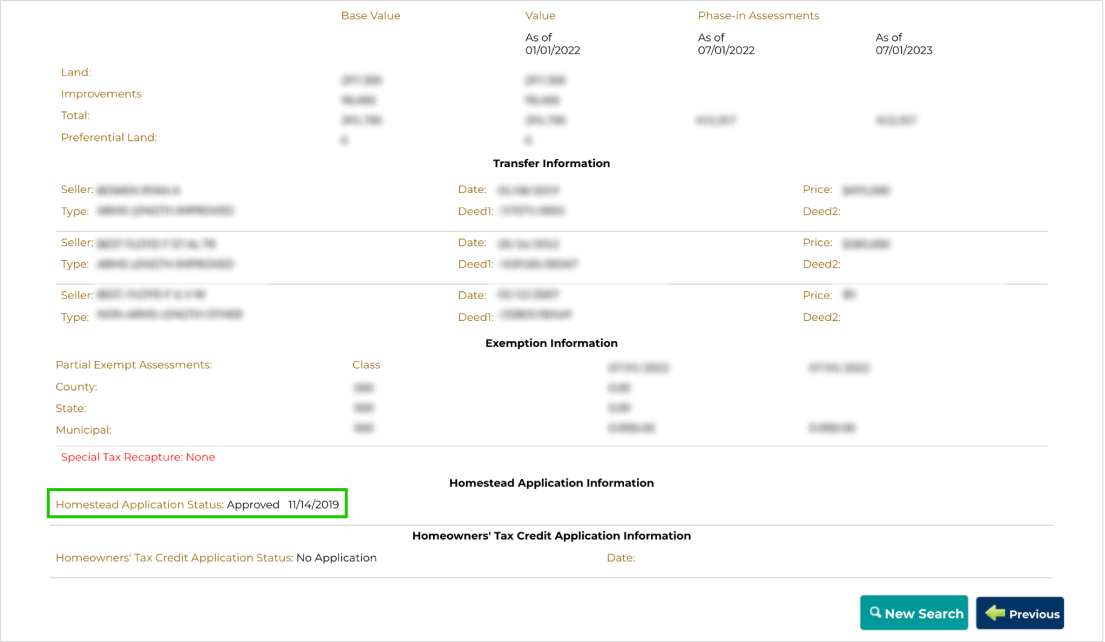

- Once you get to your information, scroll to the bottom and look for “Homestead Application Status:” (highlighted in green below).

- If it says, Approved, or Application Received, you do not need to apply again and do not need to continue to Step 2.

- If it says, No application, you need to apply. Please continue to Step 2.

- Go to

https://sdat.dat.maryland.gov/RealProperty/.

-

Step 2: Apply for a Homestead Application (if Step 1 showed, “No Application”)

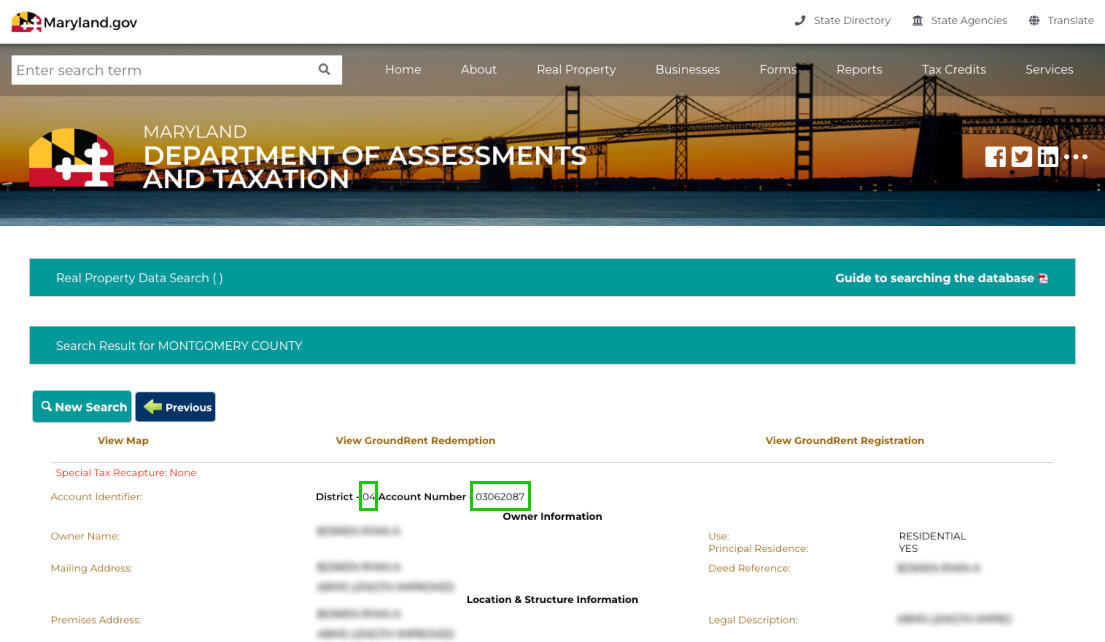

- Find your Real Property Account Number. You will need this number to file a Homestead application online or by mail.

- If you received a letter from SDAT, find the number at the top of the letter.

- If you did not receive a letter from SDAT, find your District and Real Property Account Number at the top of the Real Property search from Step 1 (outlined in green below).

- Once you have your Real Property Account Number, there are two ways you can file an application. You only need to do a. OR b.

-

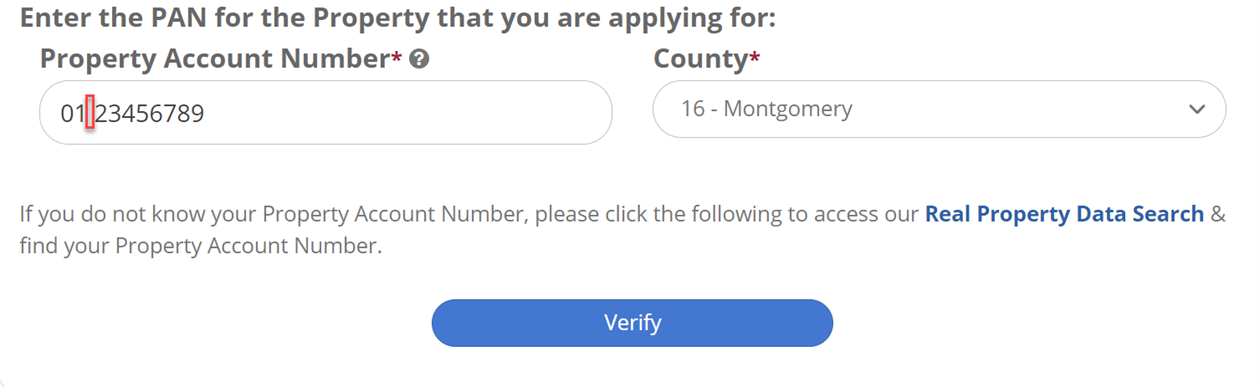

Online: Go to

Homestead Tax Credit Eligibility Application page, and complete the online form. Filing an online application will be faster than mailing one in. When filling out the form ensure that there is a space between the district and account number. Once you submit the form, you’re done!

- Mail: Go to Homestead Tax Credit Eligibility Application page, and find the “Paper Application” section. Download and print the form, or request a paper copy by phone. After completing the application, mail it to the address on the second page of the form, and you’re done!

-

Online: Go to

Homestead Tax Credit Eligibility Application page, and complete the online form. Filing an online application will be faster than mailing one in. When filling out the form ensure that there is a space between the district and account number. Once you submit the form, you’re done!

- Find your Real Property Account Number. You will need this number to file a Homestead application online or by mail.

Watch this video to learn more:

If you have questions

If you have any questions, email [email protected] or call 410-767-2165 (toll-free 1-866-650-8783).