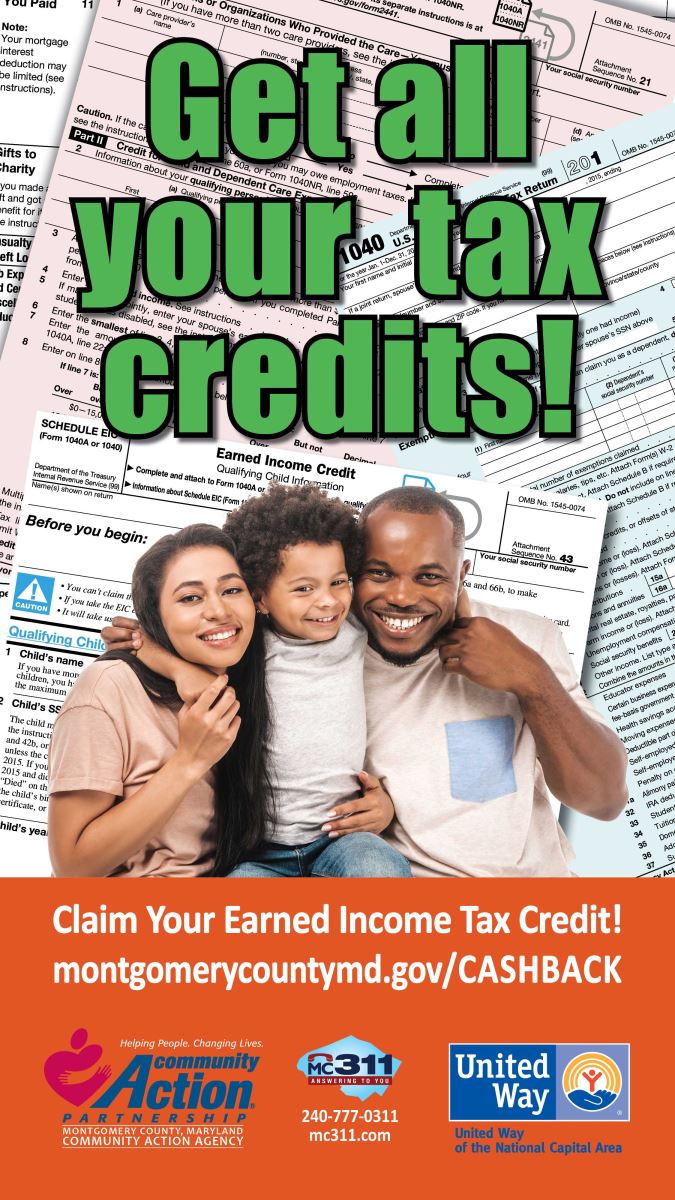

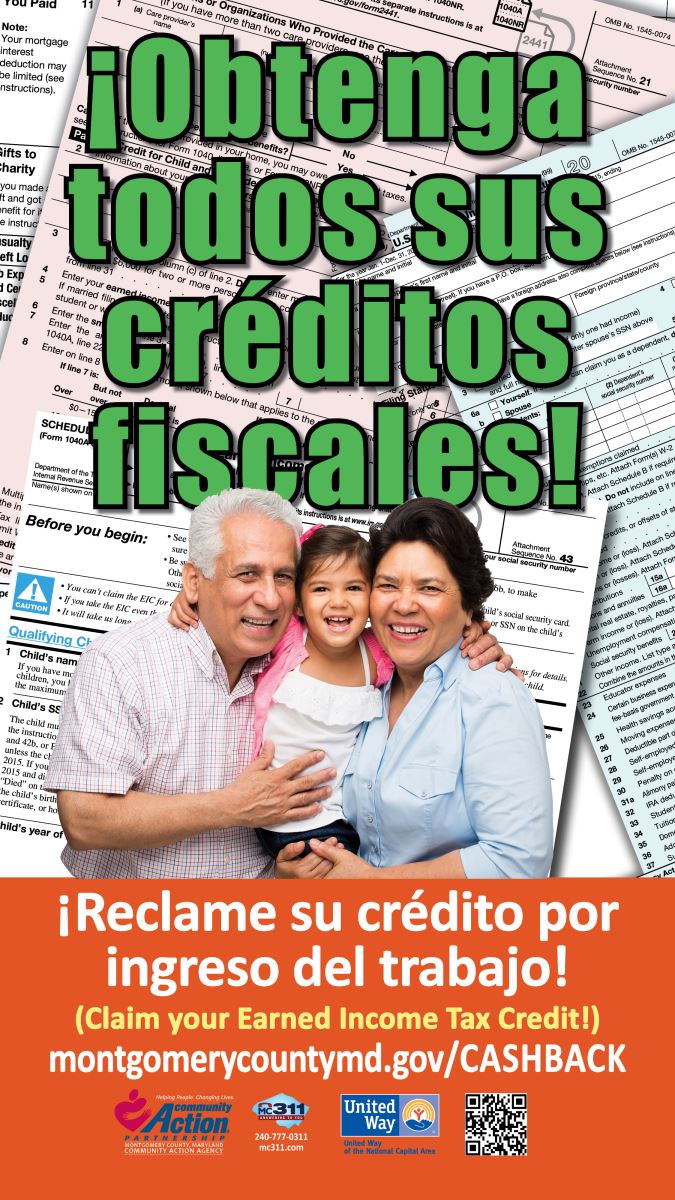

Volunteer Income Tax Assistance (VITA)

The Department of Health and Human Services, Community Action Agency

240-777-1123

The VITA program provides FREE tax preparation services for low to moderate income county residents.

VITA Appointments

In-person and virtual appointments are available for Montgomery County households earning $60,000 or less. Please check the CASHBACK website for more information.

Community Action E-Newsletter

Community Action E-Newsletter

.jpg)