County Homestead Tax Credit

The Homestead Tax Credit (HTC) limits the increase in taxable assessment each year to a fixed percentage. Every county and municipality in Maryland is required to limit taxable assessment increases to no more than 10% per year, and the State also limits the taxable assessment for the State portion of the tax to 10%. All municipalities in Montgomery County have adopted the 10% HTC limit, except for the Town of Kensington, which has a 5% HTC limit.

The credit applies only to owner occupied residential dwellings and is based on the total assessment for the land and the dwelling associated with the land. The credit does not limit the market value of the property. It is a credit applied against the tax due on the portion of the reassessment exceeding 10% from one year to the next. The credit is based on the 10% limit for purposes of the State property tax, and 10% or less for purposes of local taxation. In other words, the homeowner pays no property tax on the assessment increase which is above the limit.

There are certain conditions that must be met for credit eligibility:

- The dwelling must be the owner's principle residence and the owner must have lived in it for at least six months of the year, including July 1 of the year for which the credit is applicable, unless owner is temporarily unable to do so by reason of illness or need of special care.

- The property was not transferred to new ownership.

- There was no change in the zoning classification requested by the homeowner that resulted in an increased value of the property.

- A substantial change did not occur in the use of the property.

- The previous assessment was not clearly erroneous.

-

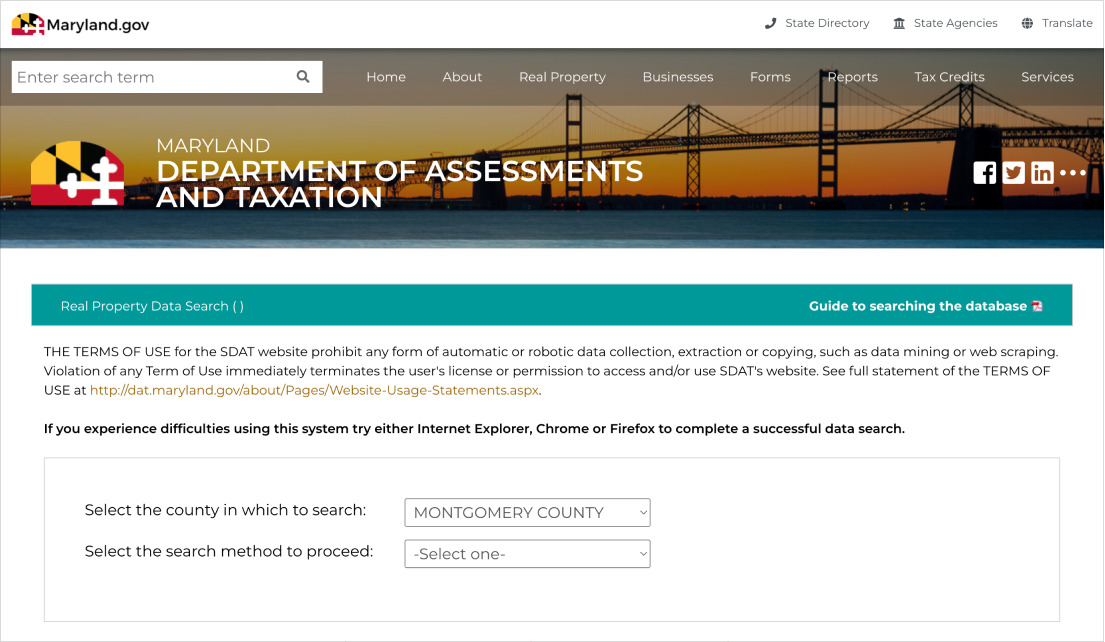

Step 1: Check if you have already filed a Homestead Application.

- Go to

https://sdat.dat.maryland.gov/RealProperty/.

- Select “Montgomery County” in the first drop down menu (as shown)

- Choose your preferred method in the second drop down menu to find your property.

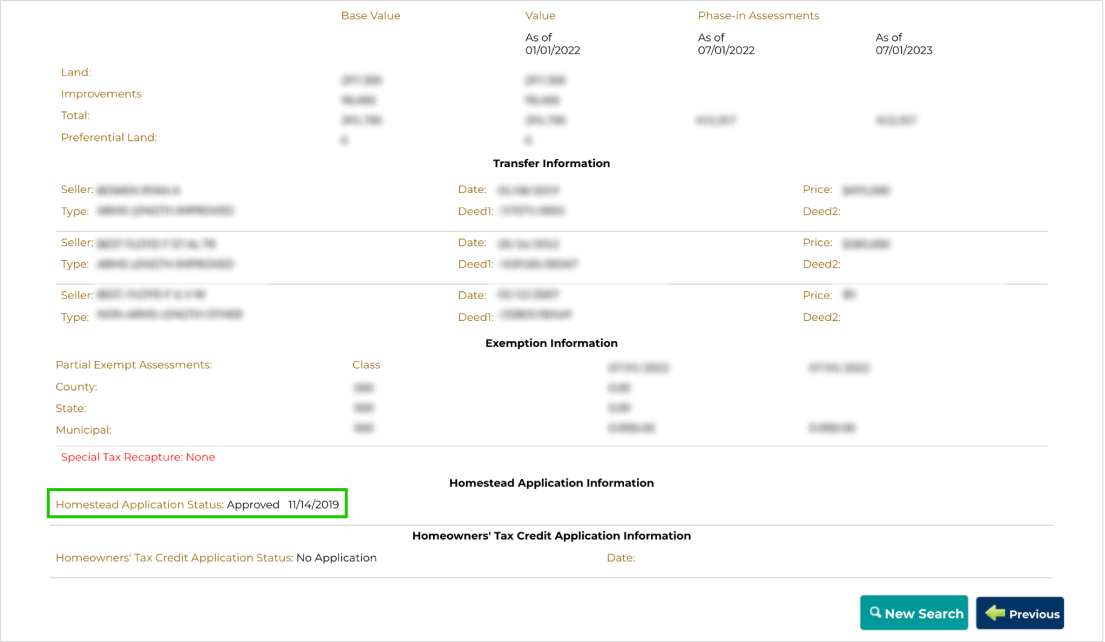

- Once you get to your information, scroll to the bottom and look for “Homestead Application Status:” (highlighted in green below).

- If it says, Approved, or Application Received, you do not need to apply again and do not need to continue to Step 2.

- If it says, No application, you need to apply. Please continue to Step 2.

- Go to

https://sdat.dat.maryland.gov/RealProperty/.

-

Step 2: Apply for a Homestead Application (if Step 1 showed, “No Application”)

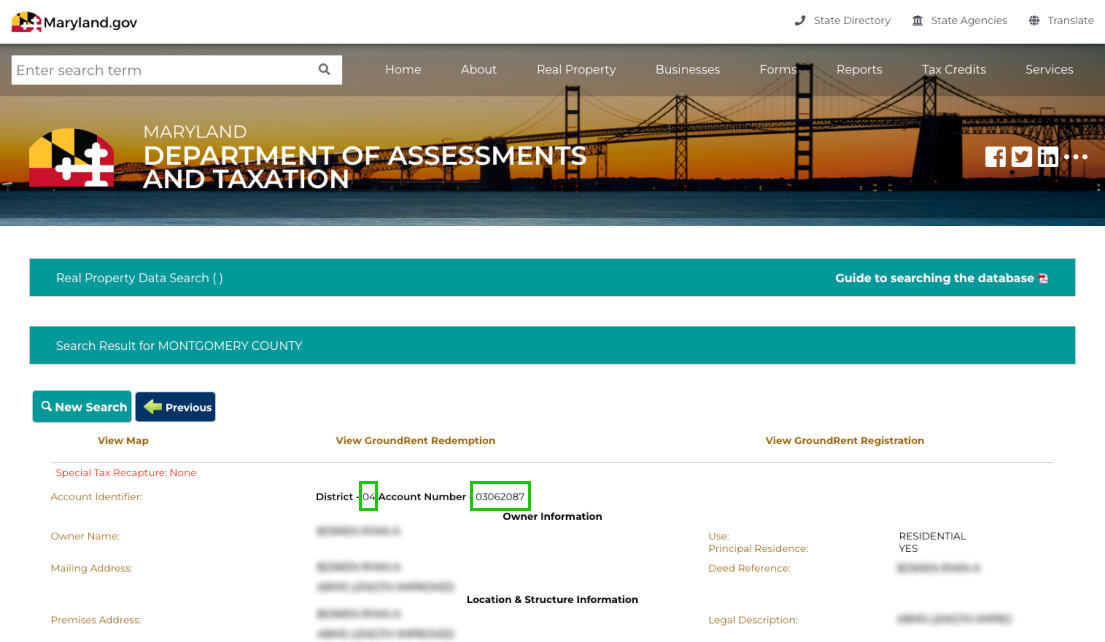

- Find your Real Property Account Number. You will need this number to file a Homestead application online or by mail.

- If you received a letter from SDAT, find the number at the top of the letter.

- If you did not receive a letter from SDAT, find your District and Real Property Account Number at the top of the Real Property search from Step 1 (outlined in green below).

- Once you have your Real Property Account Number, there are two ways you can file an application. You only need to do a. OR b.

-

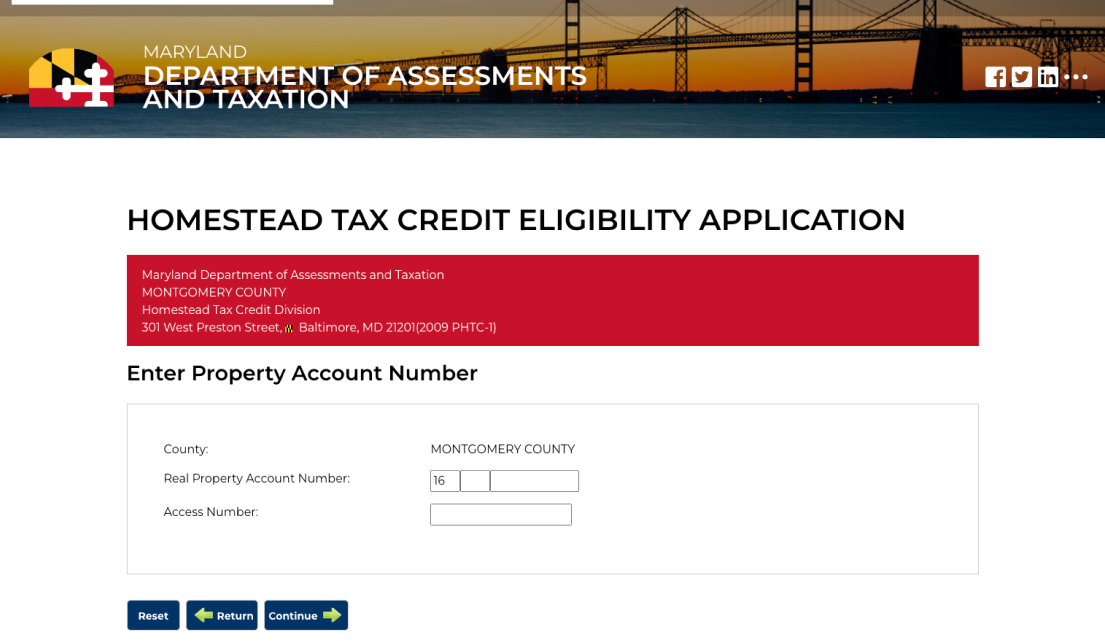

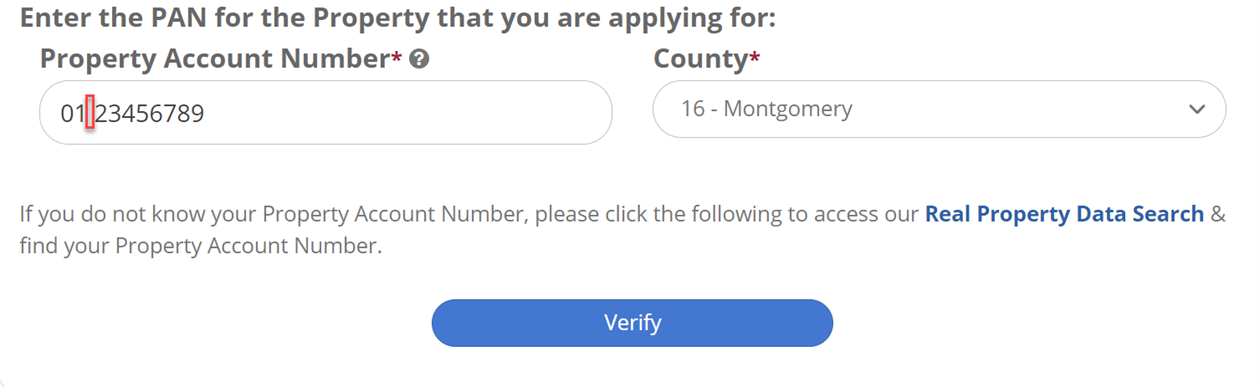

Online: Go to

Homestead Tax Credit Eligibility Application page, and complete the online form. Filing an online application will be faster than mailing one in. When filling out the form ensure that there is a space between the district and account number. Once you submit the form, you’re done!

- Mail: Go to Homestead Tax Credit Eligibility Application page, and find the “Paper Application” section. Download and print the form, or request a paper copy by phone. After completing the application, mail it to the address on the second page of the form, and you’re done!

-

Online: Go to

Homestead Tax Credit Eligibility Application page, and complete the online form. Filing an online application will be faster than mailing one in. When filling out the form ensure that there is a space between the district and account number. Once you submit the form, you’re done!

- Find your Real Property Account Number. You will need this number to file a Homestead application online or by mail.

Watch this video to learn more:

If you have questions

If you have any questions, email [email protected] or call 410-767-2165 (toll-free 1-866-650-8783).