Volunteer Income Tax Assistance (VITA)

Free tax help for income eligible households in Montgomery County.

Tax season appointments for the Community Action Agency's VITA program are available now through April 9, 2026. Appointments are for Montgomery County residents with a combined household income of $69,000.

*To schedule your free tax filing appointment, please visit our scheduling page.

Tax season appointments for the Community Action Agency's VITA program are available now through April 9, 2026. Appointments are for Montgomery County residents with a combined household income of $69,000.

*To schedule your free tax filing appointment, please visit our scheduling page.

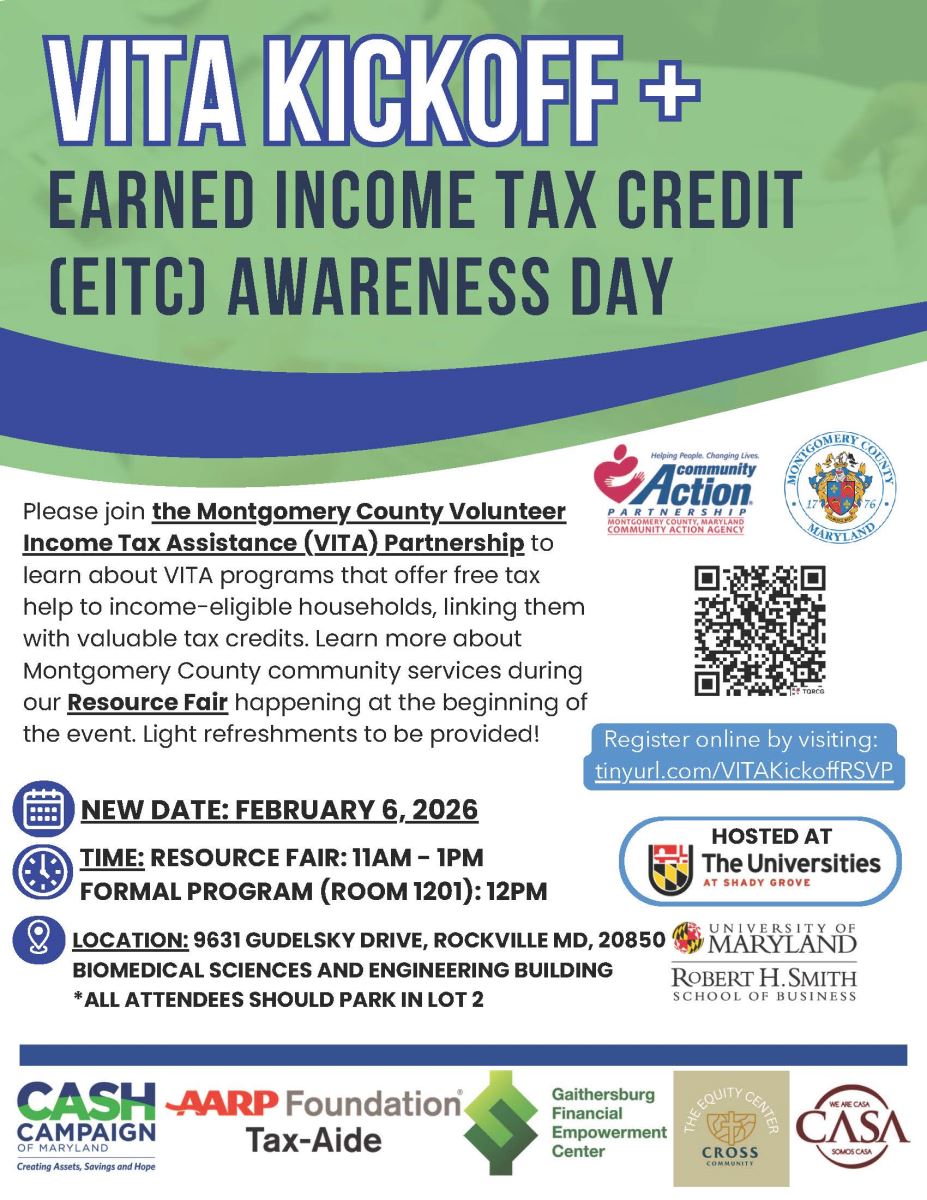

Earned Income Tax Credit Awareness Day Event

THIS EVENT HAS BEEN RESCHEDULED TO FEBRUARY 6, 2026 DUE TO INCLEMENT WEATHER

Please join the Montgomery County VITA Partnership for an Earned Income Tax Credit (EITC) Awareness Day and VITA Kick-Off event on Friday, February 6th, from 11 am - 1 pm at the Universities at Shady Grove. The event will include a resource fair and a special program with remarks from County leaders at 12 pm. This event is free and open to the public. Spanish interpretation will be available.

Register HERE.

Learn About Tax Credits

(EITC and WFIS)

If you earned less than $69,000 in 2025, you may qualify for the federal, Maryland, and Montgomery Earned Income Tax Credit. The maximum federal EITC is $8,046! If you file with an ITIN, you may qualify for the Maryland EITC, and in Montgomery County, for the Working Families Income Supplement.

Find Free Tax Help

Don’t pay expensive fees

to get your taxes done.

Go to IRS-certified tax

partners, or use free

software to claim ALL of

your money!

to get your taxes done.

Go to IRS-certified tax

partners, or use free

software to claim ALL of

your money!

Financial Education Tools

Get your refund FAST by

opening a free or low-cost

bank account. SAVE some

of your refund with U.S.

Savings Bonds. LEARN

about financial education

and consumer resources.

opening a free or low-cost

bank account. SAVE some

of your refund with U.S.

Savings Bonds. LEARN

about financial education

and consumer resources.