Find Free Tax Filing Help

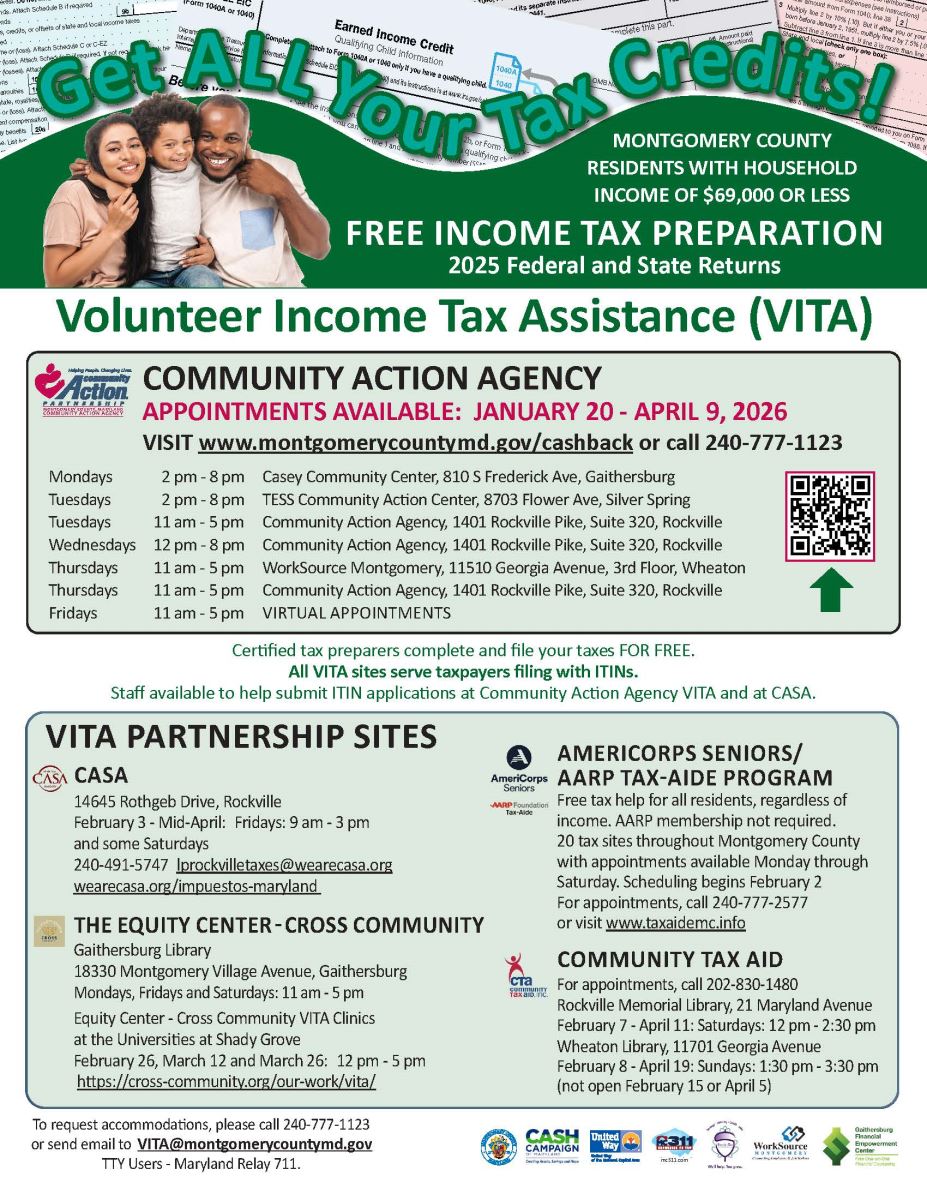

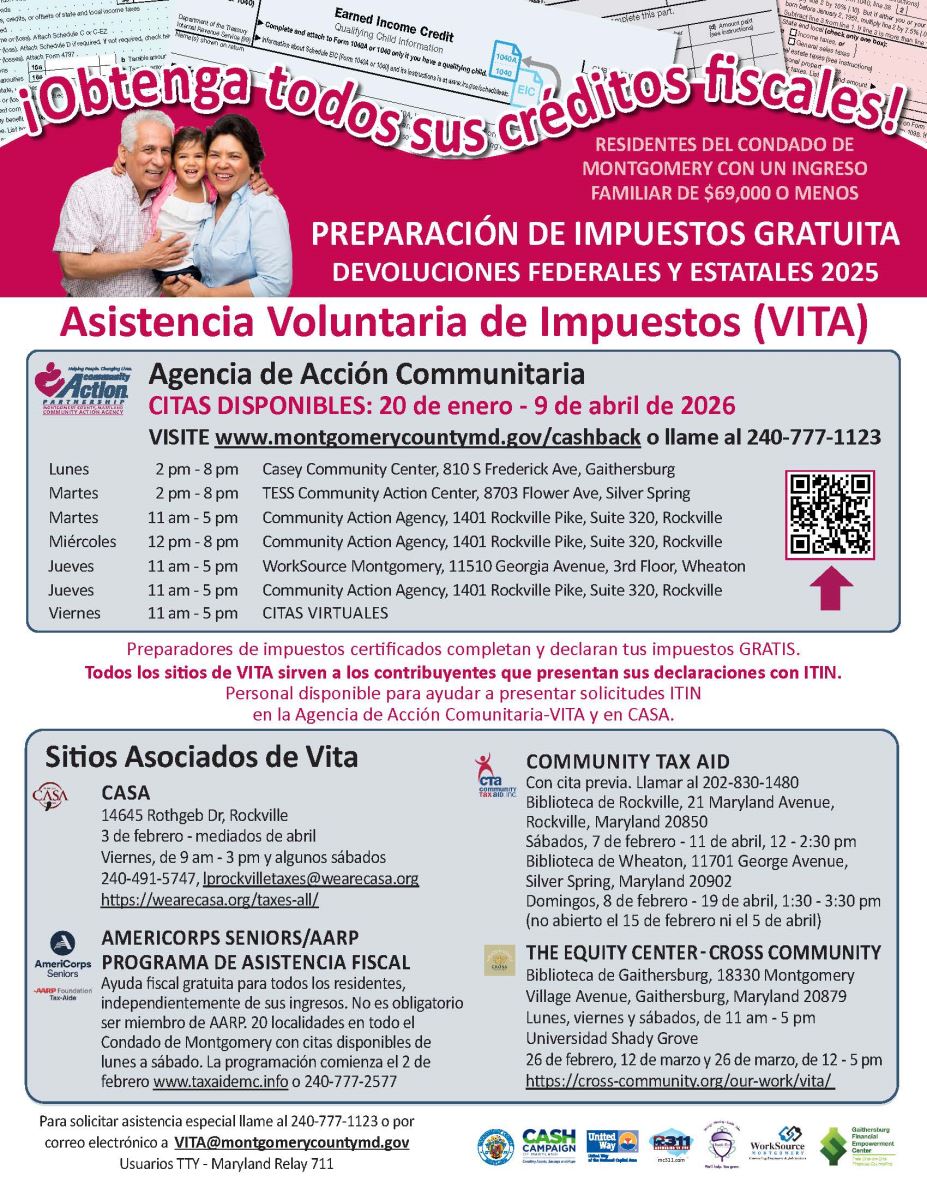

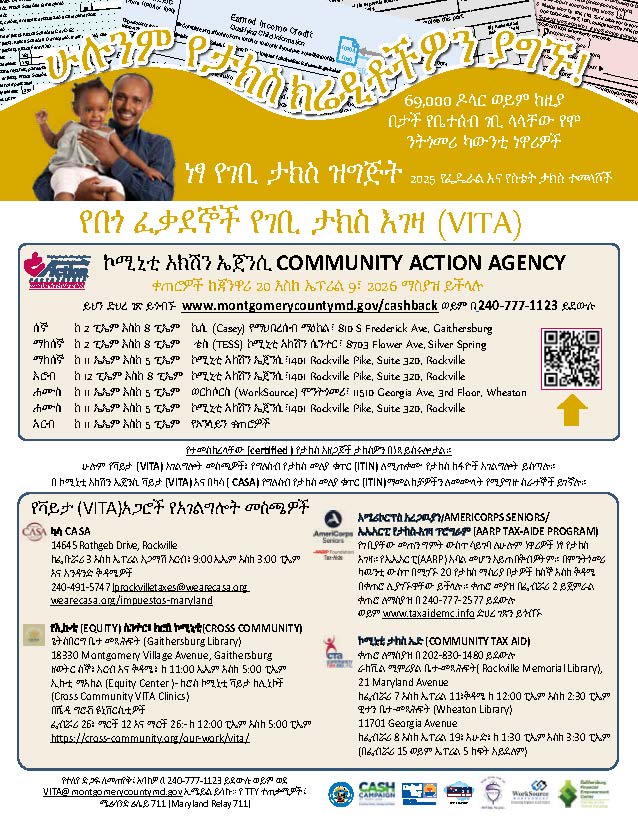

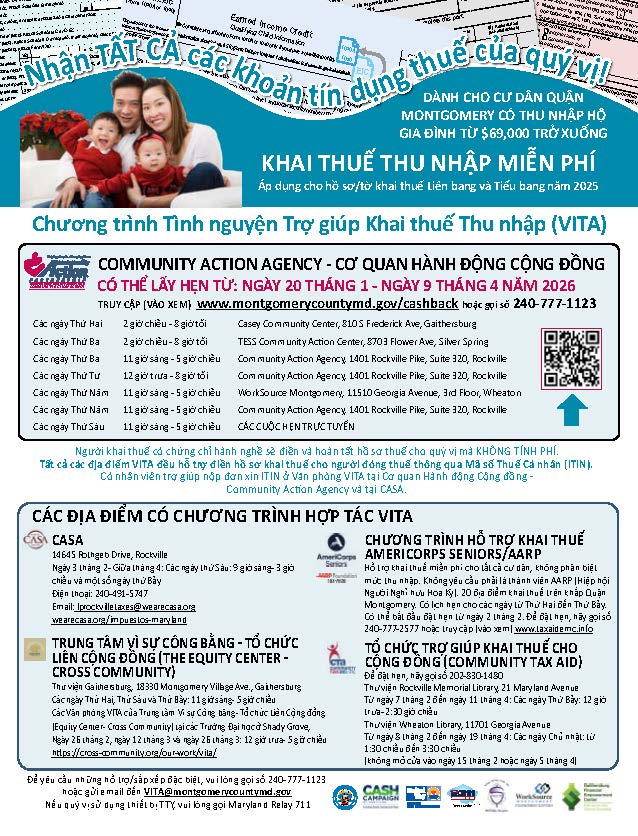

Community Action Agency Volunteer Income Tax Assistance (VITA) Program

Tax season appointments for the CAA VITA program are available now through April 9, 2026 for County residents with a combined household income of $69,000 or less.

Appointments for the tax season are now available. Schedule your appointment today!

Community Action Agency VITA Tax Season Schedule

January 20 - April 9, 2026

Mondays, 2 - 8 pm, Casey Community Center, 810 S Frederick Ave, Gaithersburg

Tuesdays, 2 - 8 pm, TESS Community Action Center, 8703 Flower Ave, Silver Spring

*The TESS VITA site is temporarily closed due to facility issues. Those with previously scheduled appointments will be contacted by the VITA program to reschedule at another site.

Tuesdays, 11 am - 5 pm, Community Action Agency, 1401 Rockville Pike, Suite 320, Rockville

Wednesdays, 12 - 8 pm, Community Action Agency, 1401 Rockville Pike, Suite 320, Rockville

Thursdays, 11 am - 5 pm, WorkSource Montgomery, 11510 Georgia Avenue, 3rd Floor, Wheaton

Thursdays, 11 am - 5 pm, Community Action Agency, 1401 Rockville Pike, Suite 320, Rockville

Fridays, 11 am - 5 pm, VIRTUAL APPOINTMENTS

*Please note that with regard to weather-related cancellations, the Community Action Agency VITA program follows Montgomery County Public Schools. If the public schools are closed due to inclement weather, VITA appointments will be cancelled and rescheduled for another day.

VITA Partnership Flyers

English |

|

|

Amharic |

Chinese |

|

Vietnamese |

VITA Partnership Sites

THE EQUITY CENTER - CROSS COMMUNITY, INC.

Gaithersburg Library - Mondays, Fridays, and Saturdays, 11 am - 5 pm

Universities at Shady Grove - February 26th, March 12th, and March 26th, 12 – 5 pm

https://cross-community.org/our-work/vita/

CASA

14645 Rothgeb Dr, Rockville

February 3rd - Mid-April

Fridays, 9 am - 3 pm, and some Saturdays

240-491-5747

https://wearecasa.org/taxes-all/

AMERICORPS SENIORS/AARP TAX-AIDE PROGRAM

Free tax help for all residents, regardless of income. AARP membership not required.

20 tax sites throughout Montgomery County with appointments available Monday through Saturday.

www.taxaidemc.info or 240-777-2577

COMMUNITY TAX AID

By appointment. Call 202-830-1480

Rockville Memorial Library, 21 Maryland Ave, Rockville, MD 20850

Saturdays, February 7 - April 11, 12 – 2:30 pm

Wheaton Library, 11701 George Ave, Silver Spring, MD 20902

Sundays, February 8 – April 19, 1:30-3:30 pm (not open February 15 or April 5)

What to Bring to Your Appointment:

- A Social Security card and/or ITIN for EACH family member. We cannot use prior year files to verify Social Security number.

- A photo ID for each filer.

- W-2 forms for all jobs worked in 2025.

- Child care provider name, address, and tax ID number or Social Security number.

- All bank account information (a voided check and/or savings deposit slip) to directly deposit your refund.

- A copy of last year’s tax return.

- Any document or information about money you have received from the IRS or state.

- All 1099 forms for other income, if any.

- Any other tax related documents you have received.

- If you are a victim of identity theft, you must bring the letter from the IRS with your PIN number. A new letter is issued from the IRS every year.

- Form 1095A if you received insurance through the Marketplace (ACA).

- If you are married and filing jointly, your spouse must be present. If you are married and filing separately, you need your spouse's name as spelled on his/her Social Security card and your spouse's Social Security number.

ITINs - Individual Taxpayer Identification Numbers

All VITA sites serve taxpayers filing with ITINs.

Staff available at the Community Action Agency VITA program and CASA VITA program to help submit ITIN applications and renewals.

Official IRS ITIN website

Staff available at the Community Action Agency VITA program and CASA VITA program to help submit ITIN applications and renewals.

Official IRS ITIN website

Frequently Asked Questions about ITINs

How is the format of an ITIN different from a SSN?

-

An ITIN begins with a “9” and the 4th and 5th digits are in the range of “50-65”, “70-88”, “90-92” and “94-99”

Can some members of a family have a SSN while other members of the family have an ITIN?

-

Yes, for example, some members of a family are only eligible for an ITIN but may have children who were born in the U.S. and are therefore eligible for a SSN.

Who can apply for an ITIN?

-

Any alien, non-resident or resident who is required to file a U.S. federal tax return

-

An individual who will be claimed as an exemption or dependent

-

An individual who does not qualify for a SSN

What form is used to apply for an ITIN?

-

Form W-7 and Form W-7 (SP)

In general, what must accompany a completed ITIN application?

-

A valid U.S. federal income tax return

-

Supporting identification and, in some cases, residency documents

File your Taxes Online

Free Filing Software/IRS Questions: The IRS Free File http://freefile.irs.gov provides free federal tax prep and e-file for taxpayers (income $89,000 or below). For toll-free tax help call 800-829-1040 for individual tax questions or 800-829-4933 for business tax questions.

If you decide to use a commercial tax preparer, please click here.

Do you need information about your refund?

- For questions about your federal tax refund, please visit the IRS website or call 1-800-829-1040.

- For questions about your Maryland refund, please visit the Online Services website or call 1-800-218-8160.

VITA Partners:

Community Action’s Volunteer Income Tax Assistance Partnership (VITA) includes numerous community partners: CASH Campaign of Maryland, the Montgomery County Volunteer Center, WorkSource Montgomery, The Equity Center, Chinese Culture and Community Service Center, the City of Gaithersburg (Bank on Gaithersburg), the Gilchrist Immigrant Resource Center, Montgomery County Head Start, Montgomery College, University of Maryland Extension, the City of Rockville, and the Gaithersburg Financial Empowerment Center. Information and outreach is supported through MC311, Department of Finance, Office of Consumer Protection, Montgomery County Public Libraries , and the National Tax Credit Campaign.

.jpg)