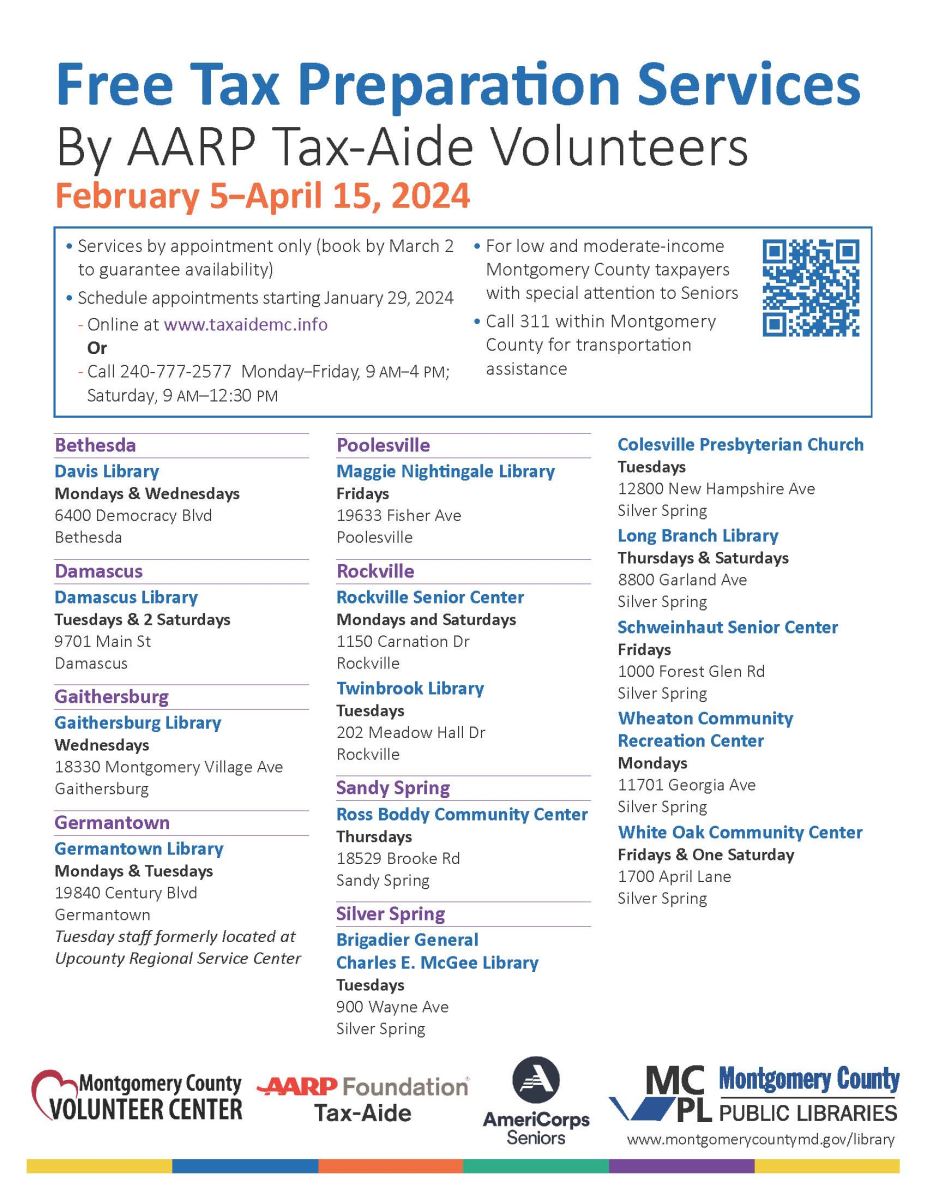

AmeriCorps Seniors / AARP Tax-Aide Program

Free tax preparation assistance is offered each year to low-to-moderate-income Montgomery County taxpayers through the AARP Foundation Tax-Aide Program. Services are provided by trained volunteers and are by appointment only. Scheduling for tax appointments is closed. Please check back in January 2025 for information.

Site locations offered in 2024:

Get our newsletter